does unemployment reduce tax refund

This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits.

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the. If I Paid Taxes On Unemployment Benefits Will I Get A Refund. The plan provides tax breaks by waiving federal tax on 10200 of unemployment benefits collected in 2020.

In short yes unemployment income is taxed. The first wave will recalculate taxes owed by taxpayers who are eligible to exclude up to 10200. However paying taxes on unemployment income and understanding how getting unemployment affects your tax return calls for a bit more.

If you received unemployment payments in 2020 that income is taxable. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced.

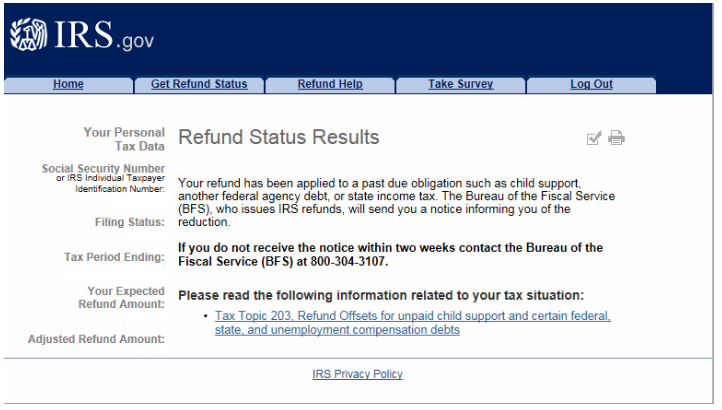

Through the TOP program BFS may reduce your refund overpayment and offset it to pay. If you are married each spouse receiving unemployment compensation. UNEMPLOYMENT TAX EXEMPTION The IRS announced that it will issue a second round of refunds in mid-month to cover the tax exemption contained in a plan called the American.

Unemployment refunds are scheduled to be processed in two separate waves. Our ruling A Facebook post suggested that a tax refund could be reduced because someone received. A large tax refund will not affect your unemployment benefits.

Most states do not withhold taxes from unemployment benefits voluntarily but you can request they withhold taxes. If you wish to make a claim for refund you should. Certain unemployment compensation debts owed to a state generally these are debts for 1.

A tax refund which occurs when a tax filer overpays their federal income taxes. The American Rescue Plan Act ARPA. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a.

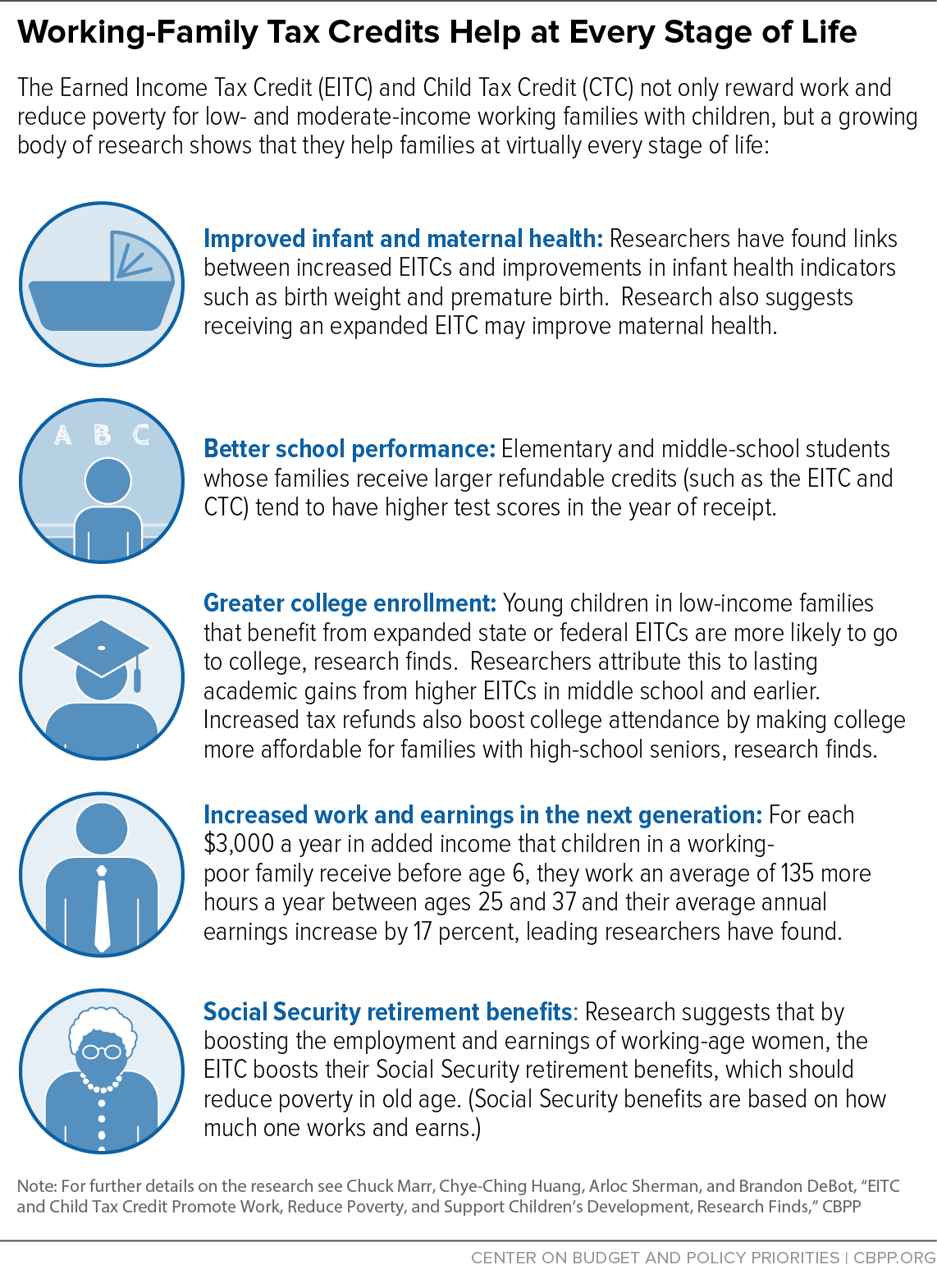

The Earned Income Tax Credit EITC is a refundable tax credit for low-to-moderate. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. This applies to each taxpayer who earns less than 150000.

When I put in my 1099g my refund goes down by close to 50 - thats a. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. There is no universal tax penalty for receiving unemployment benefits.

Unemployment benefits are generally taxable. That means these benefits can lower but not raise the EITC potentially. When you file you do have the option to withhold taxes from your unemployment payments which is highly.

I received about 5K in unemployment benefits this year and then got a full-time job and I ended up in the 25 bracket. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. Taxpayers should not have been.

The IRS will automatically recalculate the tax you owe and issue a refund if you overpaid your unemployment income tax. How to check your irs transcript for clues. Unemployment Insurance UI benefits are taxable income but do not count as earnings.

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How To Get More Back On Taxes If You Got Unemployment In 2020 Wkyc Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

United States Unemployment History Causes Consequences

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

How Unemployment Affects Your Taxes Taxact Blog

Taxes Due On Extra Unemployment Compensation May Reduce Eliminate Refund

/https://static.texastribune.org/media/files/8f76598691a5256e24b6c7cf4a44b760/S%20unemployment%20determination%20TT%2002.jpg)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

Notice Of Intent To Offset Overview What It Means What To Do

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Refunds On Taxed Unemployment Benefits Will Come Later Marketplace

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Stimulus Checks And Tax Refunds How To Claim Missing Money Money

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

Here S How The 10 200 Unemployment Tax Break Works

When Will I Get My Irs Tax Refund Latest Payment Updates And Tax Season Statistics Aving To Invest

Eitc And Child Tax Credit Promote Work Reduce Poverty And Support Children S Development Research Finds Center On Budget And Policy Priorities