tax loss harvesting wash sale

One thing to watch out for. Wash sales are not illegal.

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Wash sale rule considerations.

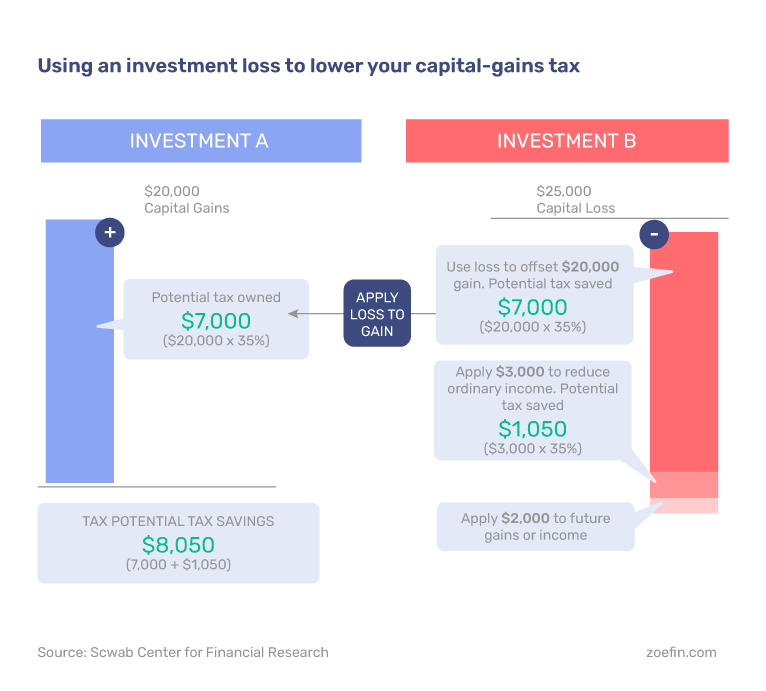

. Instead the disallowed loss increases the tax basis of the substantially identical securities. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. As you sell the lots if.

No cash may be dropped off at any time in a box located at the front door of Town Hall. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. This property at 22 Harvest Hill Dr in 08559 is currently listed for 669999.

This includes the rates on the state county city and special levels. To pay your sewer bill on line click here. This is 12 above the 599000 median price for Stockton and 12 above the 08559 median of 599000.

Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes. Tax and sewer payments checks only. But you need to familiarize yourself with the wash sale rule which.

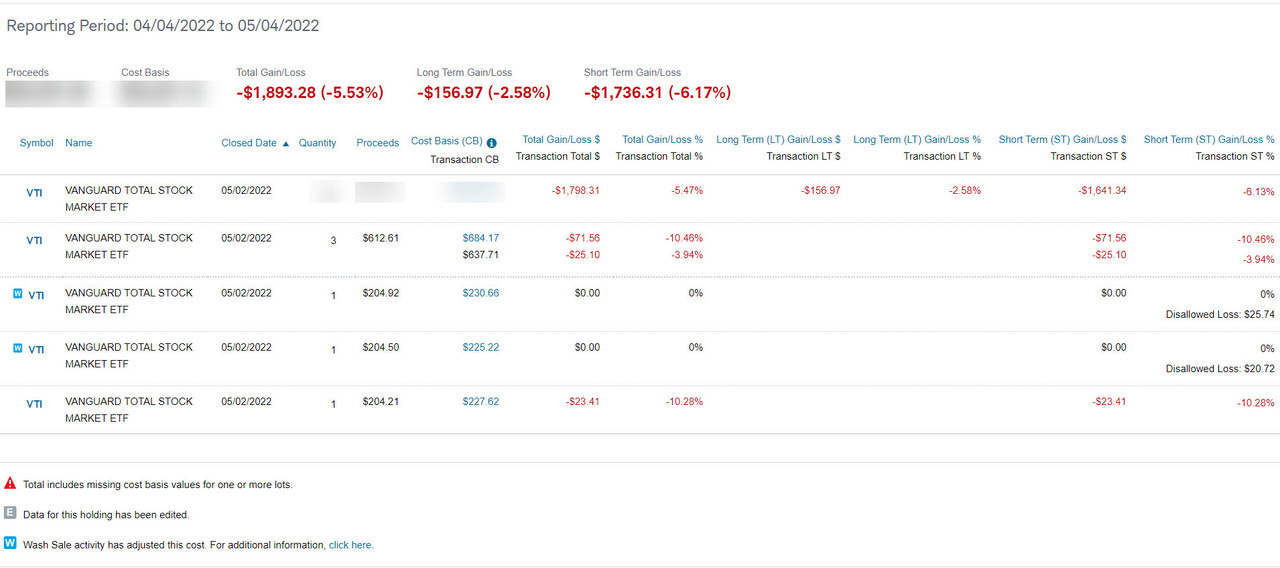

Wash Sale Rule. If you think about this rule it makes sense. The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax.

Youll want to make sure you dont inadvertently participate in a wash sale which occurs when you sell or trade stock or securities at a loss. 800 767-8040 Free Consultations Nationwide. To claim a loss for tax purposes.

To avoid the wash sale rules while still harvesting the gains you could just wait the 30 days to buy the security back. Tax loss harvesting overview. By selling crypto with unrealized losses you can realize a tax deduction to offset your capital gains or up to 3000 in.

This Single Family House is 4-bed 3-bath -Sqft listed at 695000. If you sell a fund for a loss to tax-loss harvest it you may not re-buy a substantially identical fund for 30 days. The average cumulative sales tax rate in Piscataway New Jersey is 663.

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their. Piscataway is located within Middlesex County. However when a position has a loss can be one of the worst.

Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction. Tax loss harvesting is a popular way to reduce taxes. Its not an issue to sell only some shares as long as all shares bought in the last 30 days are sold.

For Sale - 13 Harvest Ave East Hanover Twp NJ. You can use a capital loss in crypto to offset any capital gain youve realized this year -- even if it comes from the sale of another security or another property such as a stock or. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting.

When Not To Use Tax Loss Harvesting During Market Downturns

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

What Is Tax Loss Harvesting Ticker Tape

Top 5 Tax Loss Harvesting Tips Physician On Fire

Year Round Tax Loss Harvesting Benefits Onebite

Tax Loss Harvesting Definition Example How It Works

What Is Tax Loss Harvesting Truist Invest

Tax Loss Harvesting Napkin Finance

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Do S And Don Ts Of Tax Loss Harvesting Zoe

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting How To Reap The Most Rewards Diligent Dollar

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Wash Sales Seeking Alpha

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org